How CookOut sets prices

This article digs into Cookout pricing strategy with clear examples, state snapshots, and operational takeaways. The guide shows how Cookout menu pricing responds to costs, demand, and competition, while protecting gross margin and average order value. You can use these ideas to write a USA-focused, authoritative piece.

1. Quick summary: What Cookout pricing strategy means for the customer and franchisee

Customers see clear value perception when menus balance bundle pricing with simple add-ons. Franchisees need stable food cost percentage and predictable labor cost impacts to keep unit economics sane. A short summary anchors both audiences, and sets expectations for examples that follow.

Writers should place a dated price table and local price examples up front to signal freshness. That helps with price transparency and supports featured snippets, voice search, and local intent in the USA.

Why cookout pricing strategy matters for quick service restaurants, short version.

Pricing moves traffic and margin at once. Small changes shift price elasticity, alter covers, and change staffing needs. Good pricing keeps frequency high and prevents costly discount cycles.

Snapshot: typical price buckets (trays, burgers, sides, shakes).

Trays act as anchors, burgers drive volume, sides lift margin, and shakes boost profit per ticket. Show sample ranges, tag with state, and date to prove Cookout regional price differences exist.

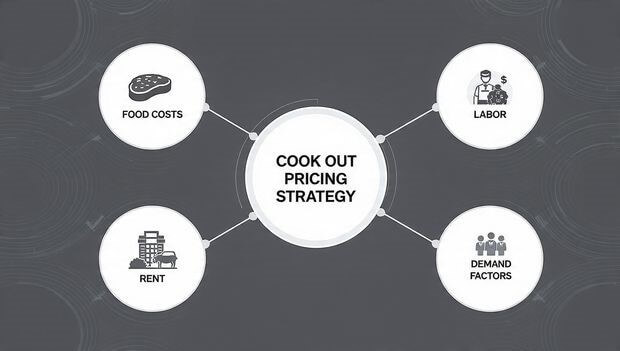

2. Core drivers behind Cookout pricing strategy (Reasons related to article)

Input costs like beef and buns determine the baseline via Cookout cost-plus pricing and supplier agreements. Labor and rent create a price floor, while seasonality changes demand and supply quickly. These drivers shape menu moves and margins.

Demand factors, such as day parts and promos, influence menu engineering choices and menu mix optimization. Brand positioning keeps signature trays affordable while premium add-ons raise average order value.

Cost inputs: food, labor, rent, supply chain shocks.

Rising ingredient prices raise food cost percentage, which lowers margins unless operators raise prices. Labor cost shifts push operators to rethink portioning, menu complexity, and staffing models.

Demand factors: day parts, promos, seasonal spikes.

Dinner peaks, weekend surges, and summer demand change willingness to pay. Promotional lift around events can be huge, but use tests to avoid margin erosion.

Brand & menu positioning: value identity vs premium items.

Cookout’s identity centers on value trays and optional premium shakes. That split lets operators keep headline prices low while upselling high margin items.

The cookout pricing strategy used (real tactics, not marketing fluff)

Cookout bundles trays to increase ticket size, uses low priced anchors to frame value, and lists high margin add-ons near the top of the menu. This is a combination of basic menu psychology and tactical anchor pricing to steer choices.

Regional price bands help franchisees adjust to local rent and wages, while the corporate office sets floors to protect the brand. POS updates make sure that pricing controls are followed, and regular price testing keeps menus up to date.

Bundle and tray pricing, loss-leader items, anchoring

Bundles lift average order value and simplify choice. Loss-leaders bring traffic, while anchors push higher margin upsells. Track menu mix optimization to judge success.

Regional price bands, pricing floor for franchise consistency.

Allow local tweaks to reflect local market pricing, but mandate minimums to prevent a race to the bottom. Franchise fee rules matter here.

4. Delivery, third-party platforms, and how they alter final price to US customers

Third-party apps add commissions and convenience fees that change customer prices and franchisee margins. Companies absorb fees, raise menu prices on the apps, or pass costs with a visible fee, this is cost pass-through in action.

Show a small comparison table that lists in-store price, owned app price, and third-party app price for one tray. Date each figure. This demonstrates Cookout delivery vs in-store pricing and clarifies Cookout third-party delivery fees.

Commission pass-through, convenience fees, menu deltas between channels.

Delivery commissions shrink unit margins; so many operators raise app prices or add fees. Monitoring channel deltas prevents confusion and protects gross margin.

5. State-level and market-level price variation

Price varies with local taxes, minimum wage, and rent, so show state snapshots for a few markets. Use North Carolina, South Carolina, and Virginia examples with sample tray prices, and explain drivers behind differences in plain terms.

State snapshots give local signals that help Google show your article for queries like Cookout pricing strategy by city. That supports voice search and local featured snippets for USA searchers.

6. Promotions, limited-time offers, and loyalty — short-term price playbook

Short promos can boost visits, but repeat discounts erode perceived value. Design offers with test cohorts and KPI gates. Measure incremental new customers, not just total sales, to see if promos add net revenue.

Loyalty programs can increase frequency without general discounting. Offer targeted rewards that improve average order value and track promotional lift by cohort.

Measuring promo lift, controlling margin erosion, best practices for time-limited offers.

Use A/B pricing and cohort analysis to separate true gains from cannibalization. Stop offers when incremental spend fails to offset margin loss.

Table, Sample local price snapshot

| Market | Item | In-store USD | Third-party USD | Date |

| Charlotte NC | Cookout Tray | 7.99 | 9.49 | 2025-09-01 |

| Columbia SC | Double Burger | 4.49 | 5.25 | 2025-09-01 |

| Richmond VA | Milkshake | 3.49 | 4.25 | 2025-09-01 |

Case study, short example

Charlotte shows lower rent than Richmond, thus the Cookout pricing strategy used for tray keeps trays cheaper there. Columbia uses promos heavily, which affects Cookout promotional pricing and average spend. These snapshots show how franchise fee impact and local costs shape pricing.

“Price tells a story about value, and thoughtful menu engineering converts that story into repeat visits,” said a franchise operator who tracks menu engineering monthly.

FAQs

What is Cookout’s pricing strategy?

Cookout focuses on value. Their signature Tray bundles an entrée, two sides, and a drink for one low price, which makes ordering simple and keeps customers feeling like they got a deal. They use upgrades like premium shakes and extra sides to increase order value without raising the base cost.

How much is a Cookout Tray?

A Regular Cookout Tray usually costs around 7.39 dollars in many US locations. A Junior Tray is a bit cheaper, around 6.39 dollars. Upgrading the drink to a milkshake normally adds around 1.00 to 1.60 dollars. Prices can vary by city and franchise.

Why do Cookout prices differ on delivery apps?

Delivery platforms add their own service fees, commissions, and convenience pricing. Some stores also adjust pricing regionally. What this really means is, the price you see on the app may be higher than in the restaurant because you are paying for the delivery ecosystem.

Does Cookout change prices by season?

Cookout rotates seasonal items, especially shakes, but they usually keep the tray price stable. You may see special flavors or limited-time sides appear, but no major seasonal price spikes.

How can Cookout franchisees raise AOV without losing customers?

The smartest approach is to keep the entry-level price low and increase spend through upgrades. For example, offering drink upgrades to milkshakes, adding extra sides or double-ups, featuring limited-time menu items, and using staff prompts or app upsells. Customers feel in control, spending more only if they want to.